Real Estate Investment: A Smart Path to Long-Term Wealth

Real Estate Investment

Real estate investment has long been considered one of the most reliable ways to build wealth. Unlike many short-term financial trends, property investment offers stability, tangible value, and multiple income opportunities. Whether you are a beginner exploring your first investment or someone looking to diversify your portfolio, real estate can be a powerful financial tool when approached correctly.

What Is Real Estate Investment?

Real estate investment involves purchasing property with the goal of earning a return. This return may come from rental income, property appreciation, or both. Investors can choose from various property types, including residential homes, apartments, commercial buildings, land, and even short-term rental properties like vacation homes.

What makes real estate unique is that it allows investors to earn money in several ways at the same time. While tenants pay rent each month, the property itself may increase in value over the years, creating long-term financial growth.

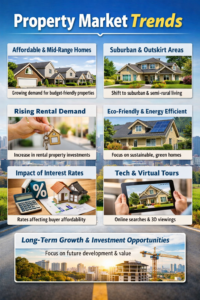

Why Real Estate Investment Is So Popular

One of the main reasons people choose real estate investment is its reputation for stability. Unlike stocks or cryptocurrencies, property values usually don’t change overnight. Real estate tends to grow steadily, especially in areas with rising population, job opportunities, and infrastructure development.

Another major benefit is passive income. Rental properties can generate consistent monthly cash flow, helping investors cover expenses and earn profit. Over time, rental income often increases while mortgage payments remain the same, improving overall returns.

Real estate also offers protection against inflation. As the cost of living rises, property values and rents usually rise as well. This means your investment keeps its purchasing power, unlike cash savings that may lose value over time.

Types of Real Estate Investments

There are several ways to invest in real estate, depending on budget and goals.

Residential real estate includes houses, apartments, and condos. This is often the starting point for new investors because it is easier to understand and manage.

Commercial real estate includes office buildings, retail spaces, and warehouses. These properties often generate higher income but require more capital and experience.

Real estate investment trusts (REITs) allow investors to earn from real estate without owning physical property. They are ideal for people who want exposure to real estate with less responsibility.

Land investment involves buying undeveloped land and holding it for future development or resale. This option can be profitable but may take longer to generate returns.

Key Factors to Consider Before Investing

Location is one of the most important factors in real estate investment. Properties in desirable areas with good schools, transportation, and job markets tend to perform better over time. Even an average property in a great location can outperform a luxury property in a poor area.

Financial planning is equally important. Investors should consider purchase price, maintenance costs, property taxes, insurance, and possible vacancies. A realistic budget helps avoid unexpected financial stress.

Market research is another crucial step. Understanding local property trends, rental demand, and future development plans can help investors make smarter decisions and avoid overpriced deals.

Risks and Challenges in Real Estate Investment

While real estate investment offers many benefits, it is not without risks. Property values can decline due to economic downturns or poor location choices. Rental properties may face issues like unpaid rent, vacancies, or maintenance problems.

Managing property also requires time and effort. Some investors choose to hire property managers, which adds to costs but reduces stress. Being prepared for challenges and having an emergency fund can help investors navigate difficult periods.

Tips for Successful Real Estate Investment

Successful real estate investors think long term. Instead of focusing only on quick profits, they plan for steady growth and consistent income. Starting small and learning from experience is often better than taking big risks early.

Building a professional network is also helpful. Real estate agents, lawyers, contractors, and financial advisors can provide valuable guidance and support.

Most importantly, patience is key. Real estate investment is not a get-rich-quick scheme, but over time, it can create financial security and lasting wealth.

Final Thoughts

Real estate investment remains one of the most trusted and effective ways to grow wealth. With careful planning, market knowledge, and a long-term mindset, investors can benefit from stable income and property appreciation. While challenges exist, the rewards often outweigh the risks for those who invest wisely. Whether you aim for passive income or future financial freedom, real estate investment can be a smart and rewarding choice.